does instacart take taxes out of paycheck

Instacart shoppers are contractors so the company will not deduct taxes from your paycheck. As an Instacart driver though youre self-employed putting you on the hook for both the employee and employer portions.

What You Need To Know About Instacart Taxes Net Pay Advance

Heres how it works.

. Does Instacart take taxes out. The service fee youll be charged will be 5 percent of your orders subtotal. They will owe both income and self-employment taxes.

The IRS establishes the deadlines for the payment. Because Instacart shoppers are contractors the company will not take taxes out of your paycheck. Original Charge shows what Instacart charged you when your order completed.

For its part-time shoppers Instacart doesnt take out taxes and they file W-2s. W-2 employees also have to pay FICA taxes to the tune of 765. Both employee and employer shares in paying these taxes each paying 765.

Everybody who makes income in the US. Does Instacart take out taxes for its employees. Youll have to pay that 765 twice over for a total of 153.

If an item has a refund amount of 000 this means the shopper refunded it before checking out at the store. Taxes and fees Like any other service or product taxes are included in the order total on your delivery receipt thats emailed to you upon the completion of your order. Open your digital receipt.

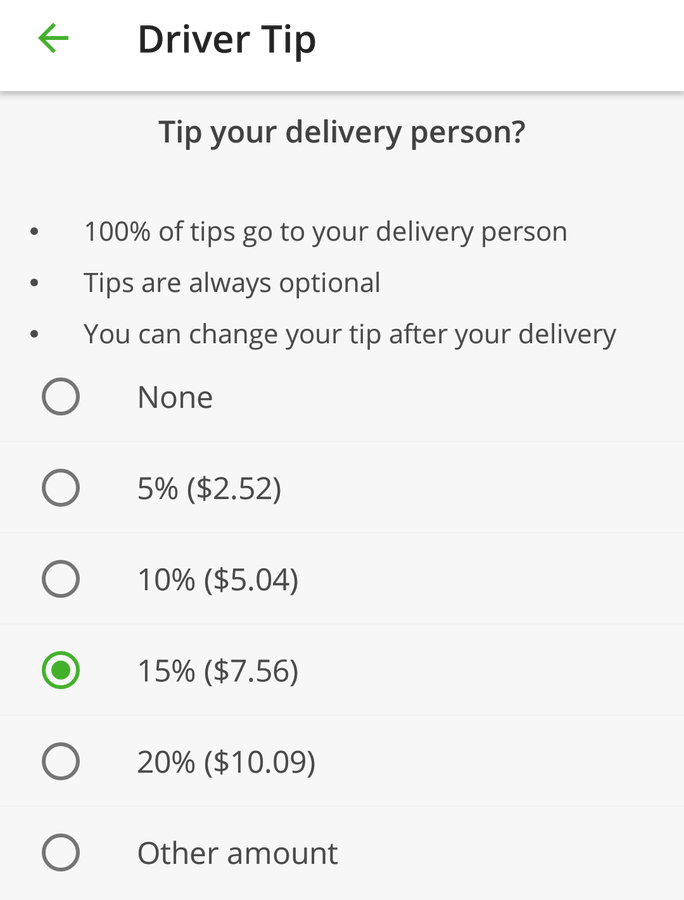

100 of your tip goes directly to the shopper delivering your order. Tax issues are somewhat complicated so we will deal with that topic. The amount they pay is matched by their employer.

Missing quarterlydeadlines can mean accruing penalties and interest. For gig workers like Instacart shoppers they are required to file a tax return and pay taxes if they make over 400 in a year. Plan ahead to avoid a surprise tax bill when tax season comes.

This is a standard tax form for contract workers. For most Shipt and Instacart shoppers. If you make more than 600 per tax year theyll send you a 1099-MISC tax form.

Only Customers shopping in Oklahoma with a 100 disabled veteran sales tax exemption card issued by the Oklahoma Tax Commission can contact Instacart Care to request a sales tax refund charged on Instacart orders. You dont send the form in with your taxes but you use it to figure out how much to report as income when you file your taxes. For self-employed individuals they have to pay the full percentage themselves.

Shopper tips are separate from any Instacart fees. For most Shipt and Instacart shoppers you get a deduction equal to 20 of your net profits. Instacart will file your 1099 tax form with the IRS and relevant state tax authorities.

As a result part-time shoppers make about 250 per hour Instacart also offers flexible scheduling. Instacart shoppers are required to file a tax return and pay taxes if they make over 400 in a year. I know it feels like a paycheck.

The exception is if you accepted an employee position. The taxes on your Instacart income wont be high since most drivers are making around 11 every hour. Instacart does not take out taxes for independent contractors.

To make saving for taxes easier consider saving 25 to 30 of every payment and putting the money in a different account. Part-time employees sign an offer letter and W-4 tax form. Tax withholding depends on whether you are classified as an employee or an independent contractor.

Scroll to the Charges section at the bottom of your digital receipt. Instacart delivery starts at 399 for same-day orders 35 or more. Because Instacart shoppers are contractors the company will not take taxes out of your paycheck.

One sneaky Instacart shopper trick is to scan your shopper receipts with a variety of reward apps. This includes self-employment taxes and income taxes. Refund for order issue shows any refunds that Instacart processed after your order completed.

You do get to take off the 50 ER portion of the SE tax as an adjustment on line 27 of the 1040. If youre an employee stop reading. 100 of your tip goes directly to the shopper delivering your order.

The first step of the Instacart shopper taxes is to calculate your estimated taxes and proactively pay estimatedincome taxes on a quarterly basis. You can save 25 to 30 of every payment and put it in a different account to make saving for taxes easier. If you pay attention you might have noticed they dont take that much out of your paycheck.

We suggest you put a reminder on your phone. To check if you received a same-day refund. For 2020 the rate was 575 cents per mile.

Instacart shoppers typically file personal tax returns by April 15th for the income you earned from January 1st to December 31st the prior year. This stuff applies just as much for Instacart Uber Eats Grubhub Postmates. Has to pay taxes.

Even though it can be. The tax andor fees you pay on products purchased through the Instacart platform are calculated the same way as in a. Shopper tips are separate from any Instacart fees.

Side note Im an idiot. No taxes are taken out of your Doordash paycheck. Only Customers shopping in Oklahoma with a 100 disabled veteran sales tax exemption card issued by the Oklahoma Tax Commission can contact Instacart Care to request a sales tax refund charged on Instacart orders.

If you have a W-2 job or another gig you combine your income into a single tax return. Because Instacart shoppers are. This means that you have to cover all your own expenses and pay your own taxes.

3015 reviews from Instacart Shoppers employees about Instacart Shoppers culture salaries benefits work-life balance management job security and more. Because Instacart shoppers are contractors the company will not take taxes out of your paycheck. But Instacart pays its in-store shoppers a base pay of 10 per hour plus commission through the service fee.

A total of 153 124 for social security and 29 for Medicare is applied to an employees gross compensation. Youll include the taxes on your Form 1040 due on April 15th. If they make over 600 Instacart is required to send their gross income to the IRS.

When Does Instacart Pay Me A Contracted Employee S Guide

Is Instacart Worth It Ultimate 2022 Guide How Much Can You Make

Does Instacart Take Out Taxes In 2022 Full Guide

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

What You Need To Know About Instacart 1099 Taxes

Instacart Pay Stub How To Get One Other Common Faqs

What You Need To Know About Instacart Taxes Net Pay Advance

When Does Instacart Pay Me A Contracted Employee S Guide

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Taxes For Grubhub Doordash Postmates Uber Eats Instacart Contractors

What You Need To Know About Instacart Taxes Net Pay Advance

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

How Much Do Instacart Shoppers Make The Stuff You Need To Know

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Instacart Taxes The Complete Guide For Shoppers Ridester Com